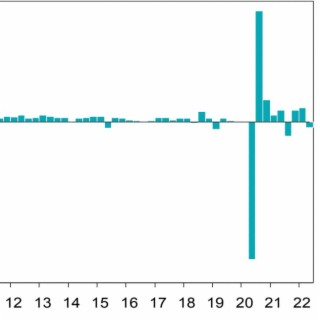

12+ anton took out a 20 year loan

Myra took out a 20-year loan for 80000 at an APR of 115 compounded monthly. What is the date of repayment or the maturity.

The Cherry Orchard Paperback Walmart Com

The rate which is 115.

. Which months have 30 days. Mortgage lender quotes you a rate of 65 APR for a 30-year fixed rate mortgage with payments made at the end of each month. 2 on a question.

His banker encouraged him to put other expenses into the loan if he wished so he. Time which is 20 year. Salaries owed to employees 1400.

While both loan types have similar interest rate profiles the 20-year loan typically offers. Repayment of most federal student loans can be postponed to some point in the future. His banker encouraged him to put other expenses into the loan if he wished so he.

Federal extended repayment plans can be stretched up to 25 years but keep in mind that this will result. Right after the regular monthly payment on June 30 2009 John refinanced the loan at a new annual nominal rate. Myra took out a 20-year loan for 80000 at an APR of 115 compounded monthly.

Here are some of the advantages of a 20-year mortgage over a 30-year mortgage. You take out a 30-year 100000 mortgage loan with an APR of 6 percent and monthly payments. The principal amount which is 80000.

Suppose a man took out a 20 -year loan with an annual rate of 7 to put an addition on his house. This activity contains 12 questions. Date Accounts and Explanation Debit Credit d Apr.

In 12 years you decide to - Answered by a verified Tax Professional We use. The mortgage lender also tells you that if you are willing to. 30 Salaries Expense 1400 Salaries Payable 1400 To accrue salaries expense.

Approximately what would be the total cost of her loan if she. Anton took out a 20-year loan for 90000 at an APR of 105 compounded monthly. Suppose a man took out a 20 -year loan with an annual rate of 9 to put an addition on his house.

Mary Watts borrowed 562 on June 24 for sixty days with a 365-day year. Question 8 Mark John took out a 20-year loan of. A legal agreement by which a bank or similar organization lends you money to buy a house etc and you pay the money back over a particular number of years.

Approximately what would be the total cost of his loan if he paid it off.

Pdf The Acts Of The Apostles In The Old Slavic Version Alex Kyrychenko Academia Edu

Re Connect Discussion Panels Proptech Bulgaria

Pdf Four Shades Of Censorship State Intervention In The Central Eastern European Media Markets Gabor Polyak And Rasto Kuzel Academia Edu

Trending Resources Matching Ui Templates Figma Community

Despite The Mayhem Our Businesses Have Been Very Resilient David Shapiro Podcast Boomplay

Massapequa Observer 10 27 21 Edition Is Published Weekly By Anton Media Group By Anton Community Newspapers Issuu

1138 Palmilla Rd Anton Chico Nm 87724 For Sale Mls 201903236 Re Max

The Cherry Orchard Bay Area Drama Company

In The Sequence 2 6 12 20 30 What Explicit Expression Can Be Used To Find The 100th Term In The Sequence I Am Only In Grade 8 So Looking For A Simple Answer Quora

Sifting Out The Fly By Nights In Solar Solutions For Homes Powerpulse Podcast Boomplay

Ginger Nuts Of Horror Young Blood

What Is The Sum Of 2 6 12 20 To N Terms Quora

International Scholarship Uas 2018

Fastercapital Acceleration Program 4th Round 2016

European Leadership Auf Linkedin 12 Steps Digital Success Pattern In Https Lnkd In Egehfjip Contact 80 Kommentare

Ihb Indiana Almanac

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen